我們有什麼可以幫您?

什麼是網格交易?

網格交易是一種基於股價波動的場景下,設定好策略參數並由系統根據參數執行低買高賣從而賺取波段差價的交易策略。

投資者事先將資產分成多份,設定好基準價格以及基於基準價格上漲下跌的價差繪製對應網格,當股價下跌觸發網格時,按照設定的價格和數量買入一份,相反當股價上漲觸發網格時,賣出一份,通過反復買入賣出的操作,賺取差價。

如何提交網格策略?

通過快捷交易抽屜或者直接進入交易大廳後,在訂單類型中選擇 “網格交易”。

按介面提示輸入價格和數量參數後提交策略。

提交完成後,在個股詳情頁可看到對應網格策略記錄,可點擊直接進入策略單詳情。

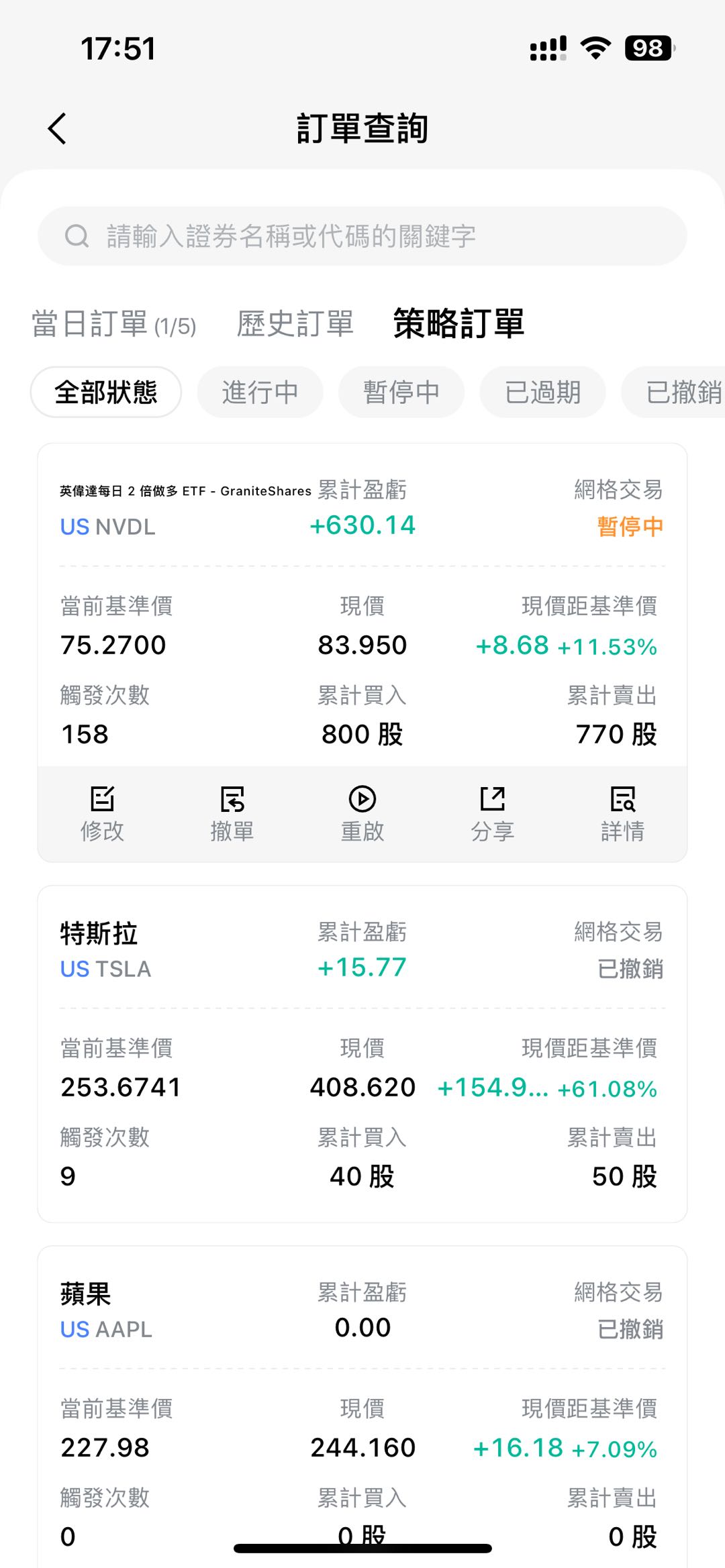

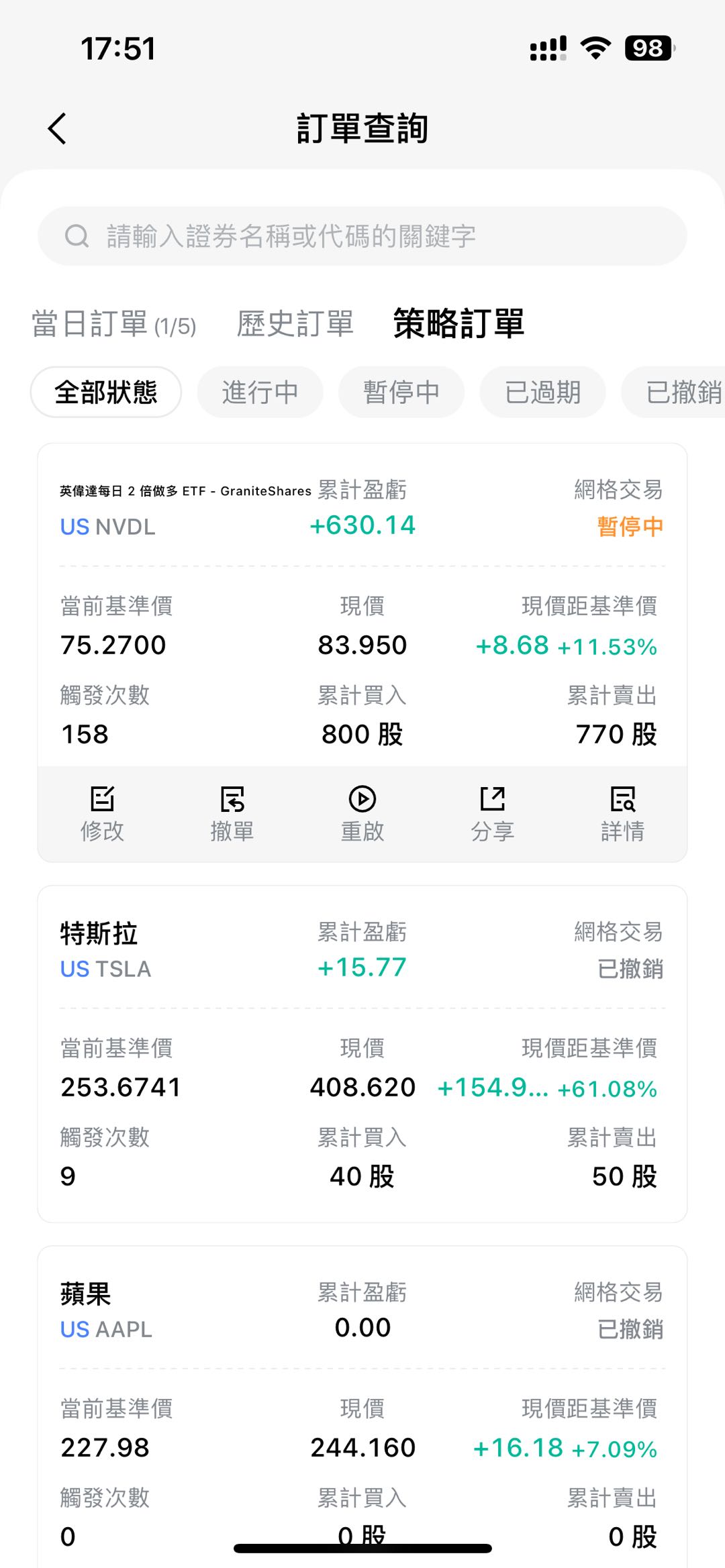

資產首頁或訂單記錄頁也可以看到策略訂單記錄,以及對應的交易和盈虧情况。

當出現策略不適用於當前行情趨勢,或者其他原因需要暫停監控的話,可點擊策略單,選擇暫停操作,或直接撤銷,若需要調整策略參數,可點擊修改進行改單操作。

策略參數如何設定?

基準價格:網格策略的初始計算價格,系統將以基準價格為起點,結合用戶設定的觸發條件,計算出基準價格上下的網格,並即時監控股票市價是否有觸及網格。當市場價格向上或向下觸發到設定網格后,觸發價格將成為新的基準價格,并依據觸發條件計算新的網格。

最大價格、最小價格:整個網格策略運行的有效價格區間,作為風險控制使用,如果運行過程中觸發價格高過最大價格或低於最小價格,則認為超出網格策略預期的有效價格區間。

超過價格區間:可選擇不做任何委託或直接按最新價清倉該股票所有倉位。

觸發條件:决定網格大小的參數,可按照價差或百分比來設定上下網格區間,並分開設定上漲或下跌觸發網格後,委託的價格。 例如基準價格為 100,按照價差上漲 1.00 元以賣一價委託,下跌 1.5 元以買一價委託,若股價漲到 101 元,觸發上方網格,按照賣一價和每筆委託數量委託賣出訂單; 若股價下跌至 98.5 元,觸發下方網格,按照買一價和每筆委託數量委託買入訂單。

- 市價(市價單):當網格觸發時會向市場下達一個市價單,實際的成交價格由當時的市場行情決定。

- 市價(限價單):當網格觸發時會向市場下達一個限價單,限價為觸發時的市價價格,實際的成交價格會優於這個限價價格,也可能不會立即成交。

- 觸發價(限價單):當網格觸發時會向市場下達一個限價單,限價為觸發價,實際的成交價格會優於這個限價價格,也可能不會立即成交。

每筆委託數量:當股價波動觸發到設定網格時,下單的數量。

有效期:支持長期單,可選項包括當日有效、撤單前有效、自定義有效期。

時段:

- 僅盤中:網格交易僅在盤中時段執行。

- 盤中 + 盤前盤後:網格交易可在盤前,盤中,盤偶時段執行。因盤前盤後時段僅支持限價單下單,觸發條件不支持選擇市價(市價單)。

倍數委託:如果打開倍數委託,當股價出現跳空高開或低開超過一個網格的情况下,按照覆蓋的網格數量委託對應倍數的每筆委託數量。

持倉區間:如果打開持倉區間控制,可設定最大最小持倉,當觸發網格後下單則檢查是否會超過持倉區間,如果超過則不進行委託。

支持賣空:如果打開支持賣空,持倉為零可自動做空。如果關閉支持賣空,持倉為零不執行賣出。

注:網格交易不支持美股夜盤及港股競價時段交易。

FAQs

Q: 為什麼行情滿足的情況下,我的網格訂單沒有觸發?

A: 可能是設置的網格最大持倉,最小持倉,價格區間,現有持倉不足,購買力不足等原因影響,建議檢查網格訂單的參數設置,確保它們符合交易條件。

Q: 為什麼行情不滿足的情況下,我的網格訂單觸發了?

A: 網格訂單的觸發是基於實時逐筆成交,而行情圖顯示的是按時間加權後的結果,這可能導致顯示的行情與實際成交情況不符。

Q: 為什麼網格設置需超過 5 個報價檔位且超過基準價的 0.5%?

A: 系統為了保護用戶,設置了參數限制,要求網格訂單的設置參數與基準價格有一定的距離。如果設置的觸發條件間隔過小,可能會導致收益不足以覆蓋交易手續費。